Contribution Margin Per Unit Formula

Gross Margin Formula Example 2. This amount is then used to cover the fixed costs.

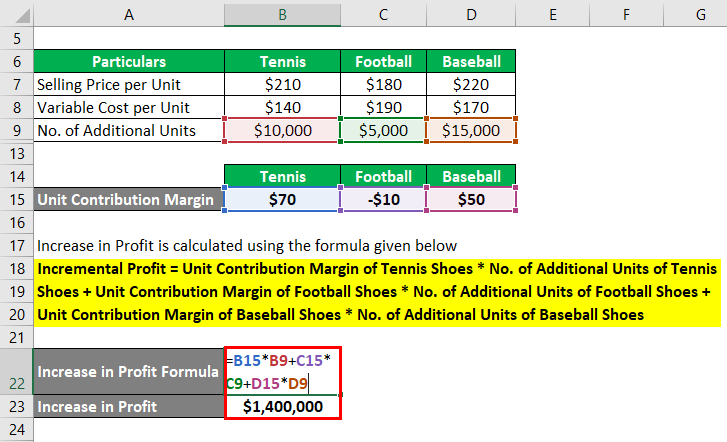

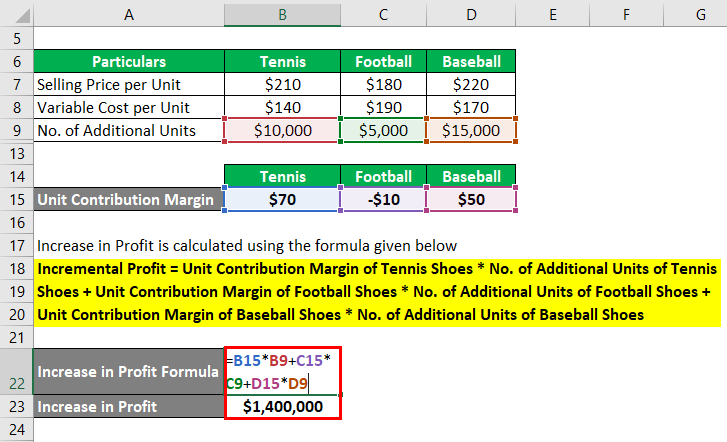

Unit Contribution Margin How To Calculate Unit Contribution Margin

Sales price per unit.

. Contribution Margin Net Sales Revenue Variable Costs. The following part of the above formula is for your contribution margin ratio. Unit contribution margin per unit denotes the profit potential of a product or activity from the.

Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. Budgeted sales revenue for the next period is 1250000 in the standard mix. The variable cost per unit is 2 per unit.

Once the breakeven point in units has been calculated the breakeven point in sales dollars may be calculated by multiplying the number of breakeven units by the selling price per unit. This concept is one of the key building blocks of break-even analysis. Using the information provided by Eastern Company calculate per unit and total contribution margin of product-X.

For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. Total revenue variable costs of units sold. In terms of computing the amount.

Fixed Costs Sales price per unit Variable costs per unit 2000150 - 40 Or 2000110 1818 units. Formula for Contribution Margin. Contribution represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs.

The planned contribution margin per unit might be 2 for the EP 5 for the full-length album and 8 for the compilation. We can represent contribution margin in percentage as well. Budgeted fixed costs are 407000 per period.

Fixed Cost Highest Activity Cost Variable Cost Per Units Highest Activity Units. Calculating the Break-Even Point in Sales Dollars. Fixed Costs See above Contribution.

Contribution margin per unit formula would be Selling price per unit Variable cost per unit Variable Cost Per Unit Variable cost per unit refers to the cost of production of each unit produced which changes when the output volume or the activity level changes. You might intend to sell 100000 albums total throughout the year including 30000 EPs 50000 full-length albums and 20000 compilations. One of the important pieces of this break-even analysis is the contribution margin also called dollar contribution per unit.

Contribution margin per unit Sales price per unit Variable expenses per unit 175 125 50 per unit 100 25. Decomposing Sales as Contribution plus. These are not committed costs as they occur only if there is.

For the year ended. The contribution margin per shoe is 500000. Variable costs per unit.

First find your contribution margin. This means Sam needs to sell just over 1800 cans of the new soda in a month to reach the break-even point. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

The Formula and Result. Variable Cost Per Unit 3769000 960000 4210 990 Variable Cost Per Unit 87236 per unit. Your planned sales mix would be 30-50-20.

Contribution margin CM or dollar contribution per unit is the selling price per unit minus the variable cost per unit. Sales Variable Costs Sales To simplify things lets use the same amounts from the last example. Again this is your sales price per unit minus your variable costs.

Divide the fixed costs by the contribution margin. The contribution margin ratio is a formula that calculates the percentage of contribution margin fixed expenses or sales minus variable expenses relative to net sales put into percentage terms. Contribution Margin Definition A contribution margin is defined as the difference between the revenue generated by.

Now lets try to understand the contribution margin per unit with the help of an example. The contribution margin is determined by subtracting the variable costs from the price of a product. For every two batches of balls sold one racquet is sold.

Fixed Cost is calculated using the formula given below. Again it should be noted that the last portion of the calculation using the mathematical equation is the same as the first calculation of breakeven units that used the contribution margin per unit. Break-Even Point Units Fixed Costs Revenue per Unit Variable Cost per Unit When determining a break-even point based on sales dollars.

The formula for contribution margin dollars-per-unit is. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales.

Contribution Margin Per Unit Per Unit Selling Price Per Unit Variable Cost. Total contribution margin Sales revenue Variable expenses 875000. For the Highest Activity.

The contribution ratio can then be calculated by dividing the CM by the selling price per unit times the number of units sold. Contribution Margin Formula. To calculate the Margin of Safety the following six steps must be followed.

Gross Margin 38. Racquets sell for 4 per unit and have a unit variable cost of 260. Fixed Costs Contribution Margin.

Contribution margin presented as a or in absolute dollars can be presented as the total amount amount for each product line amount per unit product or as a ratio or percentage of net sales.

Contribution Margin Ratio Formula Per Unit Example Calculation

Contribution Margin Formula And Ratio Calculator Excel Template

Comments

Post a Comment